The Phuket News

Asia is on track to have the oldest population in the world in the next few decades. Japan currently has the largest population of elderly people at 33.1% and this is set to bring about an unprecedented rise in healthcare costs in the long term. A high incidence of smoking and obesity throughout Asia will further compound demand for effective healthcare. The region’s spending on healthcare is estimated to reach US$2.7 trillion by 2020, notes a comprehensive report on the financial opportunities waiting to be capitalized on as Thailand leads the region in legalizing medical and medicinal cannabis.

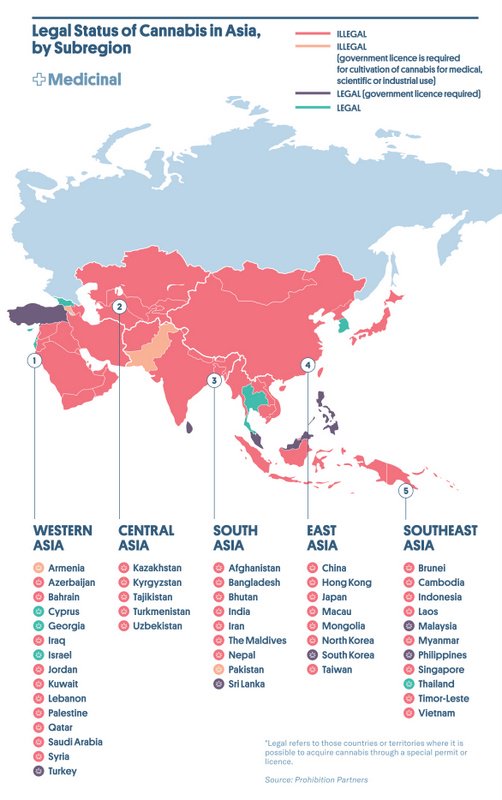

Medicinal cannabis is legal in approximately only one in five of the region’s countries, but within the last year significant developments have included legalization, the launch of medicinal cannabis plantations, and investment into research to investigate the therapeutic benefits of cannabis. In this respect, Malaysia, Thailand, Sri Lanka, Singapore and South Korea are at the vanguard of change in the region, explains the The Asian Cannabis Report, published in May by leading market analysts and advisers Prohibition Partners.

Entire countries are already lining themselves up to be early to market with their products.

South Korea has taken steps to allow imports of cannabis-derived medicines that have already been approved for use overseas. In July, state-sanctioned clinical trials to test cannabis oil in sublingual drop format on selected patients suffering from chemotherapy-induced nausea and vomiting (CINV) are planned to begin in Thailand. These developments all suggest that the availability of medicinal cannabis could experience a significant leap forward in 2019 and beyond.

Prohibition Partners estimates that the Asian medicinal cannabis market could be worth an estimated US$5.8 billion by 2024, assuming that it is legalised in the countries profiled in this report within this timeframe.

“China and Japan would be the biggest value markets accounting for an estimated 75% share in 2024. However, according to our analysis, this estimate could quadruple by 2027,” the report notes.

In Thailand, the legalization of medical cannabis was made official by royal decree in The Royal Gazette on 18 February 2019. Recreational cannabis, however, remains illegal.

Yet strong competition is already afoot.

Even in Malaysia, in February 2019, the health ministry stated that it would consider allowing the use of medical cannabis. Deputy Health Minister Dr Lee Boon Chye said, “If there is enough information to show it [medical cannabis] is safe and effective for use for certain conditions, then the ministry will be able to consider based on the particular indication.”

In January 2018, Singapore’s National Research Foundation (NRF) announced a new five-year US$18.2mn (S$25mn) synthetic biology research initiative, which also includes a Synthetic Cannabinoid Biology Program that aims to identify cannabinoid genes for the sustainable production of medicinal cannabinoids, without needing to cultivate the plant.

China makes up a large segment of the global CBD market and the country is exploring the potential of hemp strains with high CBD. The country’s Yunnan Academy of Agricultural Sciences has been promoting the cultivation of hemp for pharmaceutical use and has developed a host of new cultivars with the goal of maximizing CBD yields. More Chinese farmers are producing hemp in order to extract CBD, and the number of new specially developed high-CBD cultivars is on the rise in the country.

In 2016, Japan legalised CBD oil, but it was only in 2018 that the company—Elixinol—was first allowed to advertise its product. While CBD oil is legal in Japan, products made in the country or legitimately imported for the Japanese market must contain less than 0.3% THC.

In February, the National Legislative Assembly (NLA) took the landmark decision to approve the use of cannabis for research and medical purposes. The decision cemented Thailand’s position as the vanguard of medicinal progress in Southeast Asia, being the first country in the region to use cannabis to treat a range of conditions such as Parkinson’s disease, multiple sclerosis, drug-resistant epilepsy and pain and nausea in cancer patients.

“In addition to medical progress, the NLA decision should provide opportunities for Thai businesses and entrepreneurs, the report cautioned. The report highlights the US$237.2 million opportunity available to Thailand by 2024 should it choose to loosen restrictions on the medical cannabis market,” says Daragh Anglim is Managing Director of Prohibition Partners.

“Currently, there are only two officially sanctioned plantations in Thailand permitted to grow a strain of cannabis that is low in psychoactive compounds – less than 1% THC – to supply hospitals or government research institutes. All medical cannabis must be grown indoors to prevent illegal trade and ensure quality,” he explains.

In order for Thai businesses to benefit fully from the economic opportunity on the horizon, the legislation needs to be clarified. It’s worth noting that, while the Thai government is still tightly controlling the production and supply, foreign companies such as the British GW Pharmaceuticals and the Japanese Otsuka Pharmaceutical are alert to developments and have begun to file patent requests.

“The Thai Department of Intellectual Property has so far denied these requests, but whether this will always be the case is up for debate. Commerce Minister Sontirat Sontijirawong recently recognised that cannabis ‘is Thailand’s future cash crop’ and promised that ‘the state is doing its best to protect intellectual rights linked to research’.

“But hardworking domestic businesses will remain concerned that if future patents are granted, transnational parties will dominate the potentially lucrative market,” he adds.

“In order for Thai businesses to reap the economic rewards of a domestic market, legislation needs to be clarified. Right now, attention is fixed on regulations due to be published imminently. It is believed that these will establish licensing and prescribing criteria for medical practitioners, but it is yet to be seen whether Thai farmers and businesses can expect the same clarity around domestic cultivation,” Mr Anglim explains.

“The world is bearing witness to a chain reaction of legal change. Citizens and governments across the globe are rapidly waking up to the potential of developing medical cannabis markets, provided legislation keeps apace, Thailand is well placed to lead the pack in Asia,” he said.