BH Synergy Group is a company founded on a rich, high tech, scientific background with years of experience in the vaccine world. Currently based in Israel with access to over 25 years of legal patient use, included clinical trials, they have been active since 2013. The BH Synergy team has been working together for over 20 years, giving them the opportunity to see firsthand the physical and mental benefits from the use of cannabis. Cannabiz magazine sat down with co-founder and CEO Adam Shuster for a deeper look at this emerging, global industry.

There are a number of issues, such as regulatory challenges, which are very different in every country and jurisdiction, a change in patient awareness, and the shifting standards when it comes to medical practitioner’s perception of cannabis.

We are beginning to see good things when it comes to the standardisation, especially the standardisation of growing, extraction, packaging, distribution processes and consumption. Protocols such as EU GAP/GMP/GDP/GLP/GSP are a great start.

I believe the standards that have been set in place in Israel after over 25 years of patients use and experience with IMC (Israel Medical Cannabis) by the Ministry of Health of Israel, are both leading and setting the standards for other countries.

Being based in Israel I can attest that over a dozen different delegations from different countries around the world, some of whom we have met, have shown tremendous interest in learning of Israel’s experience and protocols.

We are aware of course of the current status in Canada, the US, and Israel as leaders in this industry, we believe that countries that develop proper regulatory practices for responsible medical cannabis use, will be ripe to take the lead and follow their burgeoning success.

We’re also closely following what is currently happening in Africa, we are particularly impressed by Lesotho and South Africa. In Asia we see fantastic traction with Australia, Thailand, and even good things in South Korea. In Central America we are aware of developing regulatory processes in Mexico and Columbia.

Of course tremendous strides are also taking place in Europe, specifically in Germany, Luxembourg, England, and Switzerland. BH Synergy Group has been approached by business leaders in these countries for assistance in the regulatory sphere, vertical operation build out and joint ventures with B2B and B2G.

The most influential market disruptions will, at this stage be a regulatory process. Meaning that as barriers to entry come down, international cross-marketing will take place in order to include quality GMP and most importantly EBM (evidence-based medicine), which is something we are currently working on sourcing here at BH Synergy Group.

BH Synergy is currently aware of over 150 pre-clinical/clinical trials taking place in Israel. We also have CRO agreements in place and JVs with some of the trials. We also believe that EBM will improve quality patient well being – the opportunity to the pharmaceutical world is tremendous.

We know that there are a lot of challenges as mentioned above. We are happy to see standardisation and regulatory processes starting to align. However, we at BH Synergy believe that every country has its own unique culture and challenges which need to be addressed and attuned to. We can see that the sharing of information of responsible medical cannabis consumption is helping bring down the barriers.

We see the positive evolution and tremendous growth of blockchain technology, which provides us with a system that records transactions using cryptography to include timestamps and transaction data. All of this gives the regulatory authorities and private businesses more security and confidentiality.

At BH Synergy we are aware of cutting-edge technologies exploiting AI. For example, the patient use and consumption of medical cannabis as well as DNA data mining will teach us to give better personal patient-based medicine. Sharing this information with qualified, controlled medical organisations will hopefully lead to accurate patient care.

Our experience in the design and construction of turn-key cultivation facilities across North America gives us access to advanced technologies, including but not limited to agro, bio and medical devices for the industry.

Amongst other things we offer dynamic cultivation systems, where the primary focus is prefab shipping container-based cultivation facilities and hybrid indoor/greenhouse cultivation facilities. The management team has extensive experience in the Pharmaceutical and cannabis industries in Israel, the United States, Canada, and Europe. The DCS team has completed over a dozen cannabis cultivation facilities across North-America.

We also focus on design & buildout, equipment sourcing and fulfilment, branding and marketing and operational management, where we help you develop and cultivate best practices that optimise space, maximise yield and deliver a consistent quality end product.

Our goal is to reduce capital and operational expenditures by providing low-cost access to equipment and supplies. We also develop effective strategies for branding and marketing plans, from crafting engaging content to designing amazing campaigns.

BH Synergy is establishing a first-class Israeli-based seed-to-sale cultivation, processing, export and R&D facility complying with IMC-GAP, IMC-GMP, IMC-GDP highest standards, and utilising Israel’s existing ecosystems to become a recognised name brand in the industry.

We are excited to come to this event in November. We know that Eman Pulis and his team know how to put together fantastic networking events on an international scale.

When he came with his team to Israel in April, he brought a team of strong, diversified people, including some of Malta’s top-level government officials. We at BH Synergy Group, on the one hand were very impressed by the professionalism and thoroughness, while on the other enjoyed the personal, family feeling. Malta’s government authorities have put medical cannabis at the forefront of industry development. We know Malta is a great place to do business and an ideal gateway into Europe. We at BH Synergy are excited and privileged to be part of this great opportunity.

Source: https://cannabizsummit.world/news/a-deeper-look-at-the-global-medical-cannabis-industry/

Martin Green

Brazil could begin cultivating medicinal marijuana this year after proposed legislation gained unanimous approval from the National Sanitary Surveillance Agency (Anvisa).

It greenlighted a 60-day public consultation on whether the country should begin to produce cannabis for medical purposes and conduct research into this field.

A draft framework for a domestic cultivation industry will then go back to Anvisa for a final vote before it is signed into law.

William Dib, president at Anvisa, said he believes that the legislation will be approved before the end of the year. If a company has the necessary land and infrastructure it could begin cultivating marijuana immediately and have the first crop ready by the summer of 2020, he added.

Anvisa would be responsible for inspecting and supervising any companies permitted to grow marijuana in Brazil, while it could call upon the federal police force for assistance if necessary. They could only supply registered pharmacies and research institutions.

Brazil is the largest economy in Latin America and the ninth largest in the world, leaving it just ahead of Canada. It has a population of around 210 million and demand for medicinal marijuana is expected to be high in the future.

In 2017, it authorized its first license for a cannabis-based medicine by allowing sales of Sativex. Two million Brazilians suffer from epilepsy, which Sativex is used to treat. Some people are also allowed to cultivate small amounts of marijuana at home to treat certain conditions, but there is not a proper medicinal cannabis industry.

HempMed Brasil, a subsidiary of the US-based Medical Marijuana Inc. (OTC: MJNA), is keen to begin producing cannabis in Brazil. “If the cultivation of the plant and the manufacture of medicines can be done in Brazil, there should be a reduction of costs and business expansion, which interests us a lot,” said vice president Caroline Heinz.

In April a group of leading Brazilian doctors went to California on a research trip to learn about the medicinal properties of cannabis. They visited the Medical Marijuana Inc. headquarters and the TERI Campus of Life, and they are now sharing their learnings with the wider Brazilian medical community.

Australian producer Creso Pharma (ASX: CHP) recently gained a license to import into Brazil and it plans to target Sao Paulo, Rio de Janeiro, and Curitiba.

The black market for marijuana in Brazil is estimated to be worth $2.4 billion, making it the biggest addressable market in Latin America, according to New Frontier.

Kyle Jaeger

The Illinois Senate voted to approve a bill to legalize marijuana on Wednesday, with just two days left to get the legislation to the governor’s desk before the current session ends.

The bill would allow adults 21 and older to consume, possess and purchase certain amounts of cannabis for personal use, and seeks to create a legally regulated system of marijuana production and sales.

It also contains several provisions aimed at promoting social equity in the legal industry, including expunging the records of individuals with convictions for marijuana possession of 30 grams or less and allowing the state’s attorney or individuals to petition the courts for possession cases involving 30 to 500 grams of cannabis.

Cannabis flower with less than 35 percent THC would be taxed at 10 percent, cannabis-infused products would be taxed at 20 percent and marijuana products with more than 35 percent THC would be subject to a 25 percent tax. That would be on top of the state’s 6.25 percent sales tax, and local jurisdictions could also impose an additional 3.5 percent tax.

Revenue would pay for implementation costs of the legal cannabis program, and would also go toward community grant programs, substance abuse centers, law enforcement efforts and the general state fund.

The Senate passed the bill in a 38 to 17 vote, sending it to the House.

“This bill helps people remove the stigma and harm caused by prior cannabis possession convictions and creates opportunities for those who want to enter the new, regulated program,” Steve Hawkins, executive director of the Marijuana Policy Project, said

Gov. J.B. Pritzker (D), who campaigned on a pro-legalization platform, has been working with lawmakers to craft legislation that emphasizes the importance of righting the wrongs of prohibition by supporting communities that have been disproportionately impacted by the war on drugs.

Long-awaited initial details about the proposal were announced earlier this month.

In the weeks

However, the bill effectively decriminalizes low-level cultivation, making it so a non-patient who grows five or fewer plants is not treated with jail time and would instead receive a civil infraction that carries a fine of up to $200.

Dan Linn, executive director of Illinois NORML, told Marijuana Moment that the revisions represent a “reasonable compromise in order to pass this bill as the legislative session comes to a close.”

“It is not perfect, but it is better than the status quo and allows adults to legally purchase, consume and, in some instances, grow cannabis,” he said. “There is still work to be done once this passes, but for now this is the best that Illinois can do.”

People who have lived in a location designated as a “disproportionately impacted area” for a certain amount of time, or who has been convicted of an offense that would be eligible for expungement, can qualify as social equity applicants for cannabis business licenses. That status would entitle people for extra points on licensing applications and fee waivers.

Separately, the bill would establish a $30 million low-interest loan program to help offset some of the startup costs associated with launching a new marijuana business for those applicants.

“We’re going to set the gold standard of how diverse an industry we can create,” Heather Steans (D), the proposal’s sponsor, said on the floor prior to the vote.

If all goes according to plan, the state’s legal marijuana program would take effect on January 1, 2020. Current medical cannabis dispensaries would have an advantage in terms of applying for licenses, and new dispensaries would receive their licenses by May 1. Processors, craft growers and transporters would be licensed by July 1.

“While the concessions to the current industry may very well undermine the social equity components for getting more diversity in ownership of the new industry, this legislation offers an end to cannabis prohibition—something that needs to happen as soon as possible,” Linn said.

Earlier on Wednesday, the Senate Executive Committee approved the revised language of the legalization proposal in a vote of 13 to 3.

During that panel’s hearing, the Illinois Chamber of Commerce announced that it was shifting its position on the legislation from opposed to neutral.

The Senate vote comes four months after the governor touted legalization in his inaugural address and three months after he included revenue from his legalization plan in a budget proposal. Pritzker said that regulating marijuana sales would “create jobs and bring in $170 million in licensing and other fees.”

A separate analysis from the Illinois Economic Policy Institute projected much higher gains: 24,000 jobs, over $500 million in tax revenue and an infusion of about $1 billion into the state economy overall by 2020.

While Pritzker said that he wanted to implement a legal cannabis system “right away” after he was elected in November 2018, that plan has taken longer to materialize. But with the bill’s Senate passage and just days left before the close of the legislative session, it seems that the governor will soon have the opportunity to make good on his campaign pledge.

Source: https://www.marijuanamoment.net/illinois-senate-approves-marijuana-legalization-bill/

Three Federal Reserve Bank presidents united in a call on April 3, 2019, for clarity on rules for providing financial services to the marijuana industry.

During a panel at the American Bankers Association Summit, the federal executives were asked about how financial institutions are expected to manage conflicting state and federal cannabis laws. All three stressed the need for a resolution to how the growing gap between state and federal marijuana laws has created difficulties for bankers and cannabis businesses alike.

Tom Barkin, CEO of the Federal Reserve Bank of Richmond

Esther George, who runs the Federal Reserve Bank of Kansas City

Raphael Bostic, CEO of the Federal Reserve Bank of Atlanta

“For better or for worse, we're responsible to follow federal law, and so we would very much like to have clarification on this,” said Tom Barkin, president of the Federal Reserve Bank of Richmond, Virginia. “Whatever legislative answer gets us to clarity would be our preferred outcome.”

Esther George, who runs the Federal Reserve Bank of Kansas City, Missouri, added that “the reality on the ground is there are businesses that are considered state-legal around this substance, and the money that is generated from that again, is a challenge for the banks.”

Choosing to service a marijuana business is “not an easy judgment for the banks to make,” she said. “They deem what's the level of risk — how do I apprise for that, how do I manage that? I think that it is particularly challenging for them, so I look forward to that resolution that provides more clarity to the bankers.”

What advice would George offer financial institutions interested in accepting cannabis business accounts?

“Do your homework,” she said. “This is a case where you have to know your customer and you have to weigh the risk of what you're worried about could happen around this.”We have to get reconciliation across federal and state law ultimately to make this work.

“We have to get reconciliation across federal and state law ultimately to make this work. In the meantime, you're going to have some of these challenging situations.”

Raphael Bostic, president of the Federal Reserve Bank of Atlanta, put the situation into starker terms. Existing federal cannabis laws put banks “in an impossible situation because we don't actually have a vote at either level but are asked to sort of navigate in this middle space,” he said.

“There's not really a clear thing for us to say — we can't give anyone 100 percent certainty in terms of how this is going to turn out,” Bostic said. “I do hope that we get some legislative clarity sooner rather than later. I would love some resolution, one way or the other, as soon as we possibly can because this is only becoming more prominent.”

Watch video of the Federal Reserve Bank officials discussing marijuana, around 49:00 in this video.

The branch presidents echoed what other top federal financial officials have said in recent months. Treasury Secretary Steven Mnuchin told senators that “this issue needs to be resolved one way or another because there are conflicts in so many regulations and rules and everything else” during a hearing in March 2019.

Another Treasury official similarly told lawmakers that “this is really something I think that Congress needs to look at because nothing that we do can or does change what is prohibited under federal law.”

A resolution might be on the horizon after the House Financial Services Committee approved legislation that would shield banks servicing cannabis businesses from being penalized by financial regulators. That bill is now awaiting scheduling for a full House floor vote.

One Wall Street firms thinks cannabis could leave the soda industry eating its dust.

Having long been considered a taboo industry, cannabis is no longer. Last year, Canada became the first industrialized country in the world to legalize recreational weed, and just weeks later a handful of U.S. states gave the green light to medical or adult-use pot during midterm elections. Today, two-thirds of U.S. states have approved marijuana in some capacity, with 66% of respondents polled in Gallup's October 2018 survey favoring the idea of legalizing marijuana.

As the cannabis industry sprouts, investors have taken notice. Last month, 15 pot stocks rallied by at least 50%, with many of the largest marijuana stocks up by a high-triple-digit or quadruple-digit percentage since 2016 began.

But with these monstrous gains, we have to ask: How big could the marijuana industry actually be?

A clear jar filled with trimmed cannabis buds, sitting atop a neatly fanned pile of twenty dollar bills.

Three lofty global sales estimates for the weed industry

Right now, there are three pretty lofty estimates from industry pundits and Wall Street analysts. The first comes courtesy of a co-authored report "2019 Update to the State of Legal Marijuana Markets," from Arcview Market Research and BDS Analytics. After delivering $6.9 billion in global sales in 2016, $9.5 billion in worldwide revenue in 2017, and an estimated $12.2 billion last year, global sales are expected to grow 38% in 2019 to $16.9 billion, and hit $31.3 billion by 2022. That's a compound annual growth rate of 26.7% between 2017 and 2022.

A second lofty estimate comes from Cowen Group sector analyst Vivien Azer. In September 2016, Azer and her team released a 110-page report, "The Cannabis Compendium: Cross-Sector Views on a Budding Industry," that outlined a trajectory to $50 billion in global sales by 2026. However, in April 2018, Azer updated Cowen's outlook for the cannabis industry by increasing its forecast to $75 billion in global sales by 2030. According to Cowen, the global pot industry is already worth $50 billion, inclusive of black market channels. Factoring in per-capita spending of $1,500 a year and 35 million annual pot users, $75 billion in global weed sales appears reasonable.

The third estimate, which came out this past week, is courtesy of Wall Street investment bank Jefferies and covering analyst Owen Bennett. Per Bennett, the global cannabis market, which includes sales estimates for 22 countries, should grow from $17 billion in 2019 to $50 billion by 2029, closely matching Cowen's initial estimate for 2026. Bennett's research note suggests that $19 billion of this will be derived from the medical marijuana market, with $31 billion in worldwide revenue coming from adult-use pot.

However -- and this is a pretty big "however" -- Bennett believes the global cannabis industry has the potential to grow to $130 billion in annual sales. That would mean the weed industry could practically double up the soda industry in about a decade, and may give the alcohol industry a run for its money, depending on whether consumers trade off alcohol consumption in favor of cannabis use.

A street sign that reads, risk ahead.

What could go wrong?

While there's certainly a path to rapid sales growth, not even the marijuana industry is impervious to "hiccups" and speed bumps. Here a few things that could go wrong and keep the industry from reaching these lofty estimates.

1. Cannabis taxes could drive consumers back to illicit channels

The first concern is the taxation of recreational marijuana sales which, as noted, should represent a clear majority of global revenue in the decade to come. California, the fifth largest economy in the world by gross domestic product, has imposed a 15% excise tax, a cultivation tax on growers of $9.25 per ounce of cannabis flower, or $2.75 per ounce of cannabis leaves, and state and local taxes. Add this up, and some locales could be paying as much as 45% in aggregate tax on adult-use cannabis, which could wind up sending legal consumers back to illicit channels.

Remember, black market marijuana growers don't have to wait for cultivation and processing licenses or sales permits. They also won't be paying state income tax, federal income tax, or the cultivation and excise taxes imposed in the state. Illicit weed will easily undercut the Golden State's legal pot industry on price, and first-year tax revenue collection figures show this to be true. Having originally expected $643 million in full-year 2018 sales following the sale of adult-use weed in dispensaries, actual collection totaled just $345.2 million last year. If U.S. states or foreign markets fail to tax cannabis appropriately, it could seriously reduce the industry's potential.

California's problems are of particular concern to Origin House (NASDAQOTH:ORHOF), which has bet big on being a distribution kingpin in the state. Origin House has been gobbling up some of the smaller pot distributors in California, thereby nabbing the few distribution licenses outstanding. But if consumers aren't actively staying within legal channels, then rampant oversupply and reduced demand could sap Origin House's potential, at least over the next couple of years.

A black silhouette of the United States, partially filled in with baggies containing dried cannabis flower, rolled joints, and a scale.

2. Legalization in key markets are no guarantee

Second, these sales expectations assume that numerous countries will legalize weed in the intermediate future. However, this isn't a guarantee. Even with two-thirds of the U.S. population in favor of legalization, there are countless obstacles that'll prevent marijuana from getting the green light in the U.S. in the near term. For instance, Republicans have a generally poor view of marijuana, and since they control the Senate and presidency, no legalization appears likely before at least 2021.

Building on this point, legalizing marijuana in the U.S. would create revenue issues for the federal government. Currently subjected to Section 280E of the U.S. tax code, pot-based businesses are disallowed from taking normal corporate income tax deductions, save for cost of goods sold. This leads to high effective tax rates and much needed revenue for the federal government. Legalizing weed would no longer mean subjecting the industry to 280E, which would cost the federal government an estimated $5 billion in revenue over a 10-year period.

3. Regulatory red tape can cause problems

Even regulatory red tape in a legal environment could lead to problems. In Canada, regulatory agency Health Canada is contending with a monstrous backlog of cultivation licenses and sales permits. These sales permits were taking the agency an average of almost one year to approve, as of May 2018. Even when demand exists, regulatory red tape could keep the cannabis supply chain from realizing its full potential.

We've also witnessed this in action, with sales projections for Canopy Growth (NYSE:CGC), the largest pot stock in the world, falling dramatically. Although Wall Street sales estimates are pretty few and far between in the early going, Canopy's top-line consensus before its third quarter report were slashed by roughly 40% in lieu of cannabis shortages and regulatory issues in Canada. Mind you, this doesn't Canopy Growth won't be successful going forward. However, it does suggest that sales growth expectations may not be achievable in the near term.

Make no mistake about it: The marijuana industry will be huge, and it's here to stay. But also understand that it won't be a risk-free ride to riches.

It would also expunge criminal records related to weed.

Take Two

For the second time, Senator Cory Booker announced a bill to make recreational marijuana use legal across the entire U.S.

The Marijuana Justice Act, which Booker and Representatives Barbara Lee and Ro Khanna announced on Thursday, would not only legalize marijuana but also retroactively erase marijuana possession charges from Americans’ criminal records, according to Rolling Stone — a monumental shift in U.S. drug policy.

Party Lines

Cory Booker, a 2020 Democratic hopeful, first introduced a similar bill in 2017 that didn’t make it out of the Senate. Still, Booker has made it clear that a major component of his presidential bid will center around ending the War on Drugs, which has led to the over-policing and incarceration of racial minorities for nonviolent crimes.

“The failed War on Drugs has really been a war on people — disproportionately criminalizing poor people, people of color & people with mental illness,” Booker tweeted Thursday morning. “I’m reintroducing the [Marijuana Justice] Act to begin reversing our failed federal drug policies.”

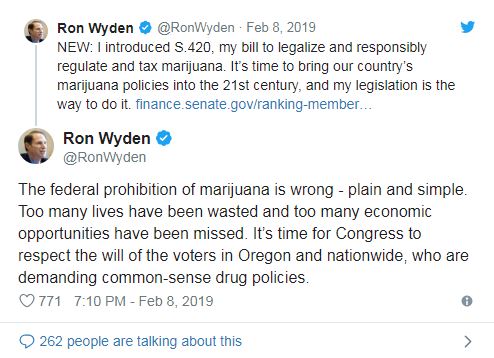

So far, other Democratic candidates Elizabeth Warren, Bernie Sanders, and Kamala Harris have all co-sponsored Booker’s new bill, according to NPR. Meanwhile, Senator Ron Wyden introduced a similar bill earlier this month.

Righting Wrongs

A major component of the Marijuana Justice Act is its retroactive effect on people who were previously charged for marijuana possession and either served time in prison or are still incarcerated.

The American Civil Liberties Union (ACLU) reports that black people are four times as likely to be arrested for marijuana possession than white people, despite similar rates of drug use.

When various states have legalized recreational marijuana, it largely benefited wealthy, white business owners who opened up distribution centers. Meanwhile, black people continued to be arrested at higher rates and the predominantly-black cohort currently in prison remained there, Vox reports.

Left Behind

If Booker’s bill makes it through the Senate this time, those people wouldn’t be left behind.

The new bill would allow people currently in prison for possession to appeal for re-sentencing. People who already served time would have their criminal records expunged, according to Rolling Stone.

“It’s not enough to simply decriminalize marijuana. We must also repair the damage caused by reinvesting in those communities that have been most harmed by the War on Drugs,” Booker said in a statement sent to Rolling Stone. “And we must expunge the records of those who have served their time. The end we seek is not just legalization, it’s justice.”

There is consensus in the Garden State that marijuana should not be a crime but no agreement on how to legalize and regulate an enormous new market.

New Jersey Inches Closer to Legalizing Marijuana Without Voter Referendum.

The deal isn’t quite done. The details still needed to be hammered out. But it looks like New Jersey, the 11th biggest state in the country, may be on the verge of legalizing marijuana.

The operative phrase in the above is “may be.”

While Gov. Philip Murphy, a proponent of legalized marijuana during his campaign for governor, and leading state legislators have come to an agreement on a way to regulate and tax marijuana, more debate is expected as the state Legislature takes up the issue. At stake is what is projected as a billion-dollar marijuana industry in the Garden State. There are other ramifications as well, such as the fact that legal weed in New Jersey may push New York lawmakers to make it legal in that state faster.

Where things stand

In New Jersey, the current issue is getting a bill through the state Legislature that would legalize recreational marijuana. Even if it moves through quickly, sales in New Jersey would likely not start until 2020.

But will it will move through quickly? Or at all?

Proponents think legalization could be approved as soon as March. “And so now we finally have an agreement in principle on tough issues like regulation and taxation. Then we must convince a majority to support it. So we’re closer than we’ve ever been,” Scott Rudder, president of the New Jersey Cannabusiness Association, told Leafly.

On the other hand, if there is a long delay with debate, more legislators may become acquainted with the arguments against legalized weed - or, at least, that is the hope of opponents such as this columnist with the Asbury Park Press.

Not a sure thing.

It has taken a year of negotiations about marijuana legalization in New Jersey because so many constituencies want different outcomes from what promises to be a huge industry. That includes issues involving taxation, regulation, the details of the licensing procedure, the rights of local jurisdictions, expungement of past pot criminal records and so on.

Democrats are not all united on this issue. According to the New York Times, Senator Ronald L. Rice, a former Newark police officer who has long represented New Jersey's largest city, leads a group of African-American lawmakers reluctant to support legalization because they worry it will harm the same low-income and minority neighborhoods ravaged by the War on Drugs.

Republicans, however, are united - in opposition. State Sen. Nicholas Scutari, who put together the bill to legalize marijuana, told the Times: “The most important aspect of it is we don’t necessarily have all the votes lined up yet.”

If legal recreational marijuana is approved by the legislature, New Jersey will become the 11th state with legal adult-use marijuana and the second to do so without a vote by the people (Vermont was the first).

Extending The SAFE Banking Act To US Exchanges Could Bring Tens Of Billions In US Cannabis Company Market Capitalization To The US

Guest post by David Wenger, General Partner at Purplerock Cannabis Partners

The most promising near-term federal cannabis legislation is the “Secure And Fair Enforcement Banking Act of 2019,” also known as the “SAFE Banking Act of 2019.” Passage of the SAFE Banking Act affording banks that service the cannabis industry protection from federal interference would be an unprecedented catalyst for the country’s fastest-growing industry; a watershed moment toward mainstreaming the industry.

But the SAFE Banking Act can be even more meaningful and impactful for the US cannabis industry, without legalizing cannabis federally.

In opening the full panoply of US banking to the cannabis industry, Congress should seize a golden opportunity to also bring more than $20 billion of US cannabis company market capitalization to the US capital markets by extending the same protections from federal interference to US stock exchanges to list US cannabis companies operating under state-legal regimes.

Federal banking guidance is urgently needed. In 2018, more than $10 billion of cannabis was legally sold in the US. Very little of those funds were deposited in a federally-chartered bank. A large portion of that money was not deposited in any bank. According to the Treasury Department, at the beginning of Q4 2018, only 375 regional banks and 111 credit unions provided some service to the entire US cannabis industry (numbers derived from some 67,000 federal Suspicious Activity Reports (SAR) banks are required to file in connection with cannabis-related activity). The actual number of banks providing full financial services to the industry is far fewer, estimated at only several dozen. Federally-chartered banks are reluctant to service cannabis companies over regulatory and legal concerns. The burdens of filing SARs can be prohibitive for smaller banks.

Without access to banking services, many cannabis companies operate on a cash basis, complicating their books, and creating a risk of robbery which has already led to several deaths. Even when banking access is provided, cannabis companies and their executives and ancillary businesses serving the industry are subject to suddenly-closed accounts, problems with banking transactions, and difficulty with international transfers.

The SAFE Banking Act would solve critical problems for cannabis banking. The purpose of the Act is: “To create protections for depository institutions that provide financial services to cannabis-related legitimate businesses.” The Act provides a “Safe Harbor For Depository Institutions.” (§ 2). Under the Act, a federal banking regulator may not: (1) terminate or limit insurance to a bank that services a cannabis company; (2) prohibit, penalize, or otherwise discourage a bank from servicing a cannabis company, (3) recommend, incentivize, or encourage a bank not to service a cannabis company; or (4) take any adverse action on a loan to a cannabis company (§ 2). Proceeds from a transaction conducted by a cannabis company “shall not be considered proceeds from unlawful activities.” (§ 3). The Act also establishes that banks and their officers and directors “may not be held liable pursuant to any federal law or regulation” for providing financial services to a cannabis company; and protects banks from any associated risks of forfeiture. (§ 4).

Essentially, the SAFE Banking Act would open the full services of the US banking industry to cannabis companies, allaying fears of federal interference. The industry owes a debt of gratitude to its champions in Washington advancing this bill, Senator Jeff Merkley (D-OR) and Representatives Ed Perlmutter (D-CO) and Denny Heck (D-WA), along with all of the bill’s bipartisan co-sponsors.

But Congress should not limit the bill to protecting “depository institutions” providing financial services to US cannabis companies. The SAFE Banking Act as drafted does not mention US stock exchanges. A historic opportunity would be missed if the Act does not also extend protections from federal interference to US stock exchanges to list US cannabis companies. The Act should include a specific provision affording the same protections from federal interference to US exchanges as is being afforded to banks.

The top 10 US cannabis companies have a combined market capitalization exceeding $20 billion. They will only become more valuable as the US legal industry rapidly expands to capture more of the already $55 billion of black-market demand and with many new consumers the legal industry will attract.

Today, that $20 billion in US cannabis company market capitalization has been created in Canada. US exchanges have refused to list US cannabis companies, owing to federal illegality, while the Canadian Securities Exchange has welcomed them, creating enormous value in the Canadian capital markets.

Though US capital markets remain shuttered to US cannabis companies, US exchanges have welcomed Canadian cannabis companies with no US operations. Cronos was the first Canadian cannabis company to list on a US exchange (Nasdaq) in February 2018, followed by Canopy, Aurora, Aphria, Hydropothecary, and CannTrust on the NYSE, and Tilray on the Nasdaq. These seven companies have a combined market capitalization exceeding $40 billion. They benefit greatly from the unrivaled liquidity offered by the US exchanges.

The NYSE and Nasdaq do not have a problem with listing cannabis companies, only with listing US cannabis companies. A puzzling situation has emerged where Canadian cannabis companies with no US operations, paying no US taxes, and having few if any employees in the US benefit enormously from the US capital markets, but multibillion-dollar US cannabis companies like Acreage, Curaleaf, MedMen, Cresco Labs, and Green Thumb Industries, headquartered in the US, employing thousands in the US, and paying millions in federal taxes cannot benefit from our capital markets.

If the SAFE Banking Act will allow JPMorgan, Bank of America, and Citigroup to provide their full range of financial services to US cannabis companies, why should the NYSE and Nasdaq not be able to list those same companies and afford them access to the US capital markets?

Support for federal cannabis legalization is at 66 percent nationally, with more than majority support in every age group, political party, and demographic. The US cannabis industry is poised for exponential growth over the coming years.

Access to banking services and the US capital markets, simultaneously, would be monumentally transformative for the cannabis industry.

Now is the time for Congress to not only provide protections to banks that want to serve the industry, but also to provide protections to US stock exchanges that want to list US cannabis companies, ensuring that the tremendous growth in market capitalization of the US cannabis industry is realized in the US. Even in the absence of federal legality, US exchanges listing US cannabis companies would add enormous value.

Bringing $20 billion of US cannabis company market capitalization to the US to be followed by many more billions as the industry grows — Democrats and Republicans alike could support that. Including protections for US exchanges in the Safe Banking Act could ultimately help to ensure passage of this crucial bill.

For the second time so far this year, marijuana legislation in Congress has been officially designated with the bill number 420. It seems to be an obvious nod to the increasingly mainstream cannabis culture from lawmakers on Capitol Hill.

Sen. Ron Wyden's (D-OR) proposal, S.420, would de-schedule marijuana by removing it from the Controlled Substances Act (CSA), establish a federal excise tax on legal sales and create a system of permits for businesses to engage in cannabis commerce.

Marijuana enthusiasts, of course, celebrate their favorite plant on April 20, also known as 4/20.

“S. 420 may get some laughs, but what matters most is that it will get people talking about the serious need to end failed prohibition," Wyden said in an emailed statement.

The new Senate bill, filed on Thursday, is far from the first time that the number 420 has officially been attached to cannabis legislation.

Just last month, another federal lawmaker from Oregon, Rep. Earl Blumenauer (D-OR), filed a congressional bill to regulate marijuana like alcohol, numbered H.R. 420.

Also last month, Minnesota state lawmakers introduced a marijuana legalization bill designated as HF 420.

In California, the first move to establish statewide medical cannabis regulations was through 2003 legislation numbered SB 420.

In 2017, a Rhode Island senator introduced bill to legalize marijuana that was designated as S 420.

And back on Capitol Hill, the first House vote on an amendment to prevent the Department of Justice from interfering with state medical cannabis laws was via 2003's Roll Call 420.

“The federal prohibition of marijuana is wrong, plain and simple. Too many lives have been wasted, and too many economic opportunities have been missed,” Wyden said in a press release. “It’s time Congress make the changes Oregonians and Americans across the country are demanding.”

NORML Political Director Justin Strekal called the new bill "a thoughtful and thorough approach to how the federal government could ultimately end prohibition."

“Hailing from the first state to decriminalize marijuana back in 1973, Senator Wyden has a unique and much-needed perspective that his colleagues in the nation’s upper chamber would be wise to follow,” he said.

Aside from S.420, which would also authorize regulations on packaging and labeling of cannabis products and apply alcohol advertising guidelines to the product, Wyden introduced two separate pieces of marijuana legislation in the Senate this week.

One of the bills, S.421, seeks to "reduce the gap between Federal and State marijuana policy." It proposes a number of changes such as exempting state-legal marijuana activity from the CSA, allowing banking access for cannabis companies, eliminating advertising prohibitions, expunging criminal records, shielding immigrants from deportation over marijuana and allowing Department of Veterans Affairs doctors to issue medical cannabis recommendations.

The other piece of legislation, S.422, would exempt state-legal cannabis businesses from the federal provision known as 280(E), which prevents them from taking normal business tax deductions that are available to operators in other industries.

This third bill is the only one of Wyden's new proposals that comes with initial cosponsors. Also signing on to the legislation are Sens. Rand Paul (R-KY), Michael Bennet (D-CO) and Patty Murray (D-WA).

Wyden filed previous versions of all three bills during the last Congress, but none were brought to a vote.

The new cannabis legislation comes at a time when legalization advocates are more hopeful than ever before about the prospects for federal marijuana reform.

Next week, the new House Democratic majority will hold a hearing on marijuana businesses' lack of access to banks, part of a plan Blumenauer proposed in a memo to party leaders that entails moving a number of incremental reform bills leading up to the eventual federal legalization of marijuana in 2019.

“Oregon has been and continues to be a leader in commonsense marijuana policies and the federal government must catch up,” Blumenauer in a press release. “The American people have elected the most pro-cannabis Congress in American history and significant pieces of legislation are being introduced. The House is doing its work and with the help of Senator Wyden’s leadership in the Senate, we will break through.”

On Friday, Blumenauer filed House companion versions to go along with Wyden's three new Senate bills.

A number of additional bills with differing approaches to end federal marijuana prohibition have been introduced in Congress in recent years, and it remains to be seen which formation House leaders will choose to advance, if any, and whether the Republican-controlled Senate would go along.

President Trump, for his part, has signaled support for moves to end federal marijuana prohibition.

In the meantime, activists are reacting to the increasing interest in marijuana reform on Capitol Hill and lawmakers' nods to cannabis culture with a mixture of lighthearted optimism.

“With 420 legislation pending in both chambers of Congress, the next logical step is for lawmakers to sit in a circle and finally hash out their differences,” NORML's Strekal joked.